You’ve done your research, and you’re ready to purchase a home. Your credit report hits the mark, so now you’re ready to start checking out mortgage loan options. This loan can take years to pay off, so it’s a good idea to shop around to pick the best option for you.

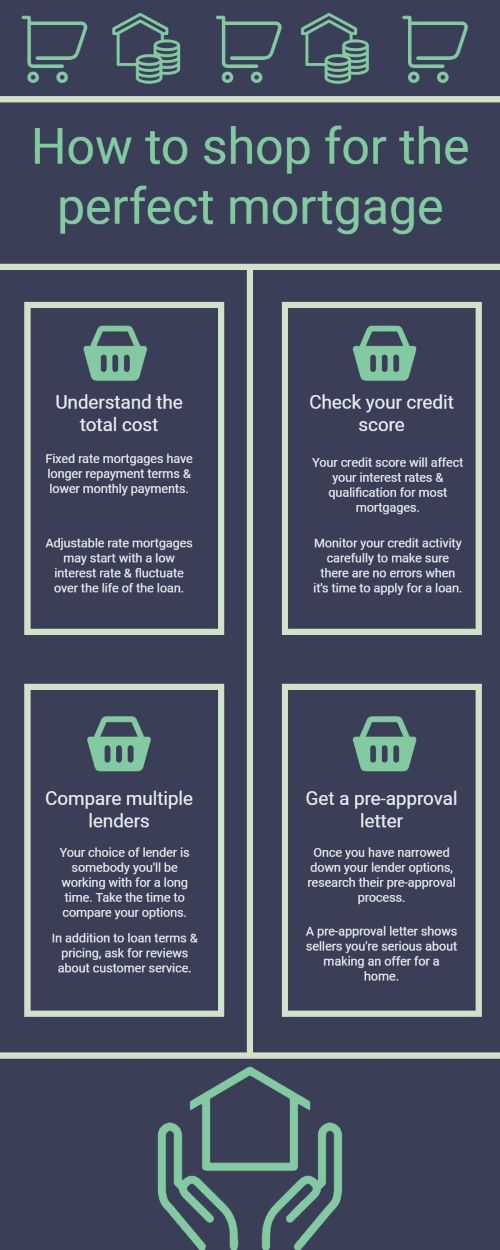

Learning the cost of a mortgage

Credit scores play a large role in the cost of a mortgage. If the score is lower, it may contribute to higher interest rates and a higher monthly mortgage payment.

A fixed rate mortgage is a great option if you don’t want the interest rate to alter with time. This type of loan has a preset rate, which is typically paid over the span of 15 or 30 years. Longer loan terms will decrease your monthly payment. Over the lifespan of this loan, the interest rate will remain constant.

Adjustable rate mortgages may start with a fixed interest rate, but are subject to change. This means if the insurance and property tax increase over time, you may see this included in the mortgage payment. Mortgages are made up of your property tax, principal, insurance and interest rates. Changes to any of these factors can affect your monthly payment.

Checking your credit score

Your credit score will help a mortgage lender determine if you’re qualified to take on the loan and can handle the interest rates involved. You want to stay on top of checking your credit history to make sure the score is where it should be. A history of paying your bills on time will work in your favor.

Shopping around for multiple lenders

There are so many options available - it isn’t enough to just know the monthly payment. Finding the right fit for a mortgage lender can be a tricky process.

Consult your real estate agent for suggestions. They often have experience with multiple lenders, so they can help you create a list of firms fitting your criteria. This will provide the opportunity to compare interest rates, monthly payments and figure out which option is best for you.

Inquire about a pre-approval letter

Once you have narrowed down your lender prospects, research their pre-approval letter process. Make sure your credit score is acceptable and then request an approval letter. A pre-approval letter is not an official offer for a loan, but signifies a lender has inquired about your financial state and affirmed you meet requirements to be offered funding. Having a pre-approval letter also shows sellers you’re serious about putting in a valid offer for their property.

When you’re ready to buy a house, check and compare quotes and negotiate loan rates. Make sure your credit score is at a place accepted by most lenders. Once you have found a potential lender, you’ll be well on your way to homeownership.

About the Author

Jamie Jamieson

Professional Association National Association of Realtors (NAR) New York State Association of Realtors (NYSAR) Hudson Gateway Association of Realtors/ Hudson Gateway Multiple Listing Service Education I hold an A.A in Italian Studies and an A.S in Accounting as well as being one of few students accepted into the Cambridge University International Student Study Program abroad as a returning student in 2011. Community Involvement I am proud to serve on the Home & School Board for St. Augustine School in Ossining and maintain the role of a Girl Scout leader. I am an active member of the community assisting in a variety of fundraising efforts. Personal I am a young and energetic agent who prides myself on providing personalized service with honest representation whether you are buying or selling your home. My expertise of the river towns, attention to detail and excitement for real estate are a few of the many assets I will bring to you. I will utilize my eagerness and market knowledge of the area to build lasting relationships with all of my clients that will extend far beyond the closing table. Be at ease from start to finish with my help. In my spare time, I love exploring the Hudson Valley with my husband, three children and our dog, Pippin. I love scoping out the infinite restaurants, farmers markets and other fabulous activities this exciting county has to offer. Experience Before joining William Raveis Legends Realty Group I started my career with Hudson Homes Sotheby's International Realty team. Prior to real estate, I had a remarkable 15+ year career in Restaurant Management/Hospitality including Ruth's Chris Steakhouse, Rivermarket and several establishments in Newport, Rhode Island. My experience in that field provided me with the foundation of excellence in customer service. Areas Covered All of Westchester County and parts of Putnam County.